HE-BCI record 2015/16 - Coverage of the record

HE-BCI record 2015/16 - Coverage of the record

Version 1.0 Produced 2016-01-28

- Purpose of the Higher Education - Business and Community (HE-BCI) record

- Scope of the HE-BCI record

- Uniformity of returns

- Audit

- General guidance for the HE-BCI record

Purpose of the Higher Education - Business and Community (HE-BCI) record

- The HE-BCI record is the main vehicle for measuring the volume and direction of interactions between UK HEPs and business and the wider community. The record has collected data for each academic year from 1999/2000.

The HE-BCI record collects information regarding the whole HEP rather than any constituent team or function. There may be numerous examples of HEPs with one department engaging with international partners in research projects while another is embedded in regional economic development; in such circumstance it is expected that the respondent provides the most useful summary within the format of the HE-BCI record.

- Part A of the HE-BCI record is designed to collect information on the infrastructure, capacity and strategy of HEPs. Data here are less likely to be considered as potential funding metrics but do provide invaluable information (at the HEP as well as regional and national levels) for HEPs and policy makers alike. Overall it is expected that the senior staff responsible for third stream activity would provide informative responses under Part A.

- Part B of the HE-BCI record is primarily concerned with gathering numeric and financial data regarding third stream activity. While any low-burden questionnaire is likely not to capture everything given the complexity of such interactions, the majority of an HEP's third stream income should be reflected under HE-BCI.

- Funding bodies in the UK draw on HE-BCI record data to inform funding of Knowledge Transfer and this remains one of the key drivers for collection of the information. In addition, a range of other public and project funders such as HM Treasury, BEIS and the Research Councils use the HE-BCI record to produce key performance indicators and also for monitoring and international benchmarking between Europe and North America.

- The HE-BCI record covers a range of activities: from the commercialism of new knowledge, through to the delivery of professional training, consultancy and services, to activities intended to have direct social benefits. ‘Business' in this context refers to both public and private sector partners of all sizes and sectors, with which HEPs have interactions.

- HE-BCI seeks to use financial and numeric data as a proxy for the HEP's engagement with the economy and society. Therefore, while there are areas of apparent overlap between the Finance and the HE-BCI records, both collect different data for different reasons. The same activity (for example contract research income) may be returned under both records but there should be no assumption that all external income has a place within HE-BCI (as is the case for the Finance record).

- It is imperative that the HE-BCI record is completed uniformly, and so all HEPs should follow the Notes of guidance provided. This will then allow the data to be compiled in a consistent manner and for meaningful interpretations of the data to be made. All monies should be shown in units of £1,000 and where necessary be independently rounded to the nearest £1,000. For example, £147,700 should be entered as 148.

- It is likely that any audit carried out on the HE-BCI record data will be concerned with headline KT income figures; for example HEPs should be confident of the total income from knowledge-related business interactions with the majority of data returned under appropriate headings even if it is not possible in a small minority of cases to draw exact distinctions between categories such as consultancy and facilities and equipment-related services.

- In order to achieve a balance between data needs for HEPs and funding bodies, HE-BCI record guidance allows for a certain degree of expert estimation in certain parts of the return, namely where totals are to be disaggregated into subcategories. Where such estimation takes place, HEPs are required to keep records of the details and it is expected that they will be able to make provision for these data within their data capturing systems once embedded as part of the Finance record. However, that data from the HE-BCI record that is used to inform funding is likely to be included alongside other data as part of the general funding data audits; this is already happening in Wales.

- When completing the HE-BCI, please use the same conventions as required for the completion of the HESA Finance record. As per these conventions VAT charged to customers should not be included in income figures collected in HE-BCI.

- For the HE-BCI record (Tables 1 to 5) it is income rather than fEC which should be returned.

- Data should not be returned more than once in Tables 1 to 5, except for the specific sub-set of questions regarding regional partners and overseas interactions. Financial data should always be returned as reported in the HEP's audited accounts. Income accounted for in the HESA Finance return may also be reported within HE-BCI Part B.

- Information is requested to be provided at the level of SME (including sole-traders and micro business), Other (non-SME) commercial businesses and Non-commercial (including public sector, not-for-profit and charities). Data are also required to be reported by Region and Overseas.

It is important for the record to distinguish between types of partner (such as SMEs and non-commercial businesses) to allow for the understanding that there may be a number of indirect economic benefits brought about by these interactions that may be additional to those provided to larger commercial business. For example, Continuing Professional Development (CPD) for nurses may be delivered to either public or private health providers although the former is likely to be seen as having a wider social impact.

The data supplied within the return are required for the following reasons:

a. To assist in the production of third stream activity information.

b. To assist in the production of management information.

c. To support policy development.

d. To provide metrics to drive the allocation of public funds.

e. To further develop HEPs' infrastructure in this area.

It is therefore important that the return should be completed as consistently as possible between one HEP and another and between successive years.

Scope of the HE-BCI record

Conventions to be used in the HE-BCI record

Uniformity of returns

Audit

General guidance for the HE-BCI record

SMEs are classified as enterprises which:

- employ fewer than 250 employees worldwide (including partners and executive directors), and

- has either an annual turnover not exceeding 50m euros, or an annual balance sheet total not exceeding 43m euros, and

- conforms to the following independence criteria:

An enterprise is considered independent unless 25% or more of the capital or of the voting rights is owned by an enterprise falling outside the definition of an SME whichever may apply, or jointly by several such enterprises. (This ceiling may be exceeded if the enterprise is held by public investment corporations, venture capital companies or institutional investors, provided no control is exercised either individually or jointly, or if the capital is spread in such a way that it is not possible to determine by whom it is held).

SMEs include micro, small and medium enterprises, and sole traders. See http://ec.europa.eu/enterprise/enterprise_policy/sme_definition/index_en.htm for the full definition.

Non-commercial businesses include the public sector, not-for-profit organisations and charities.

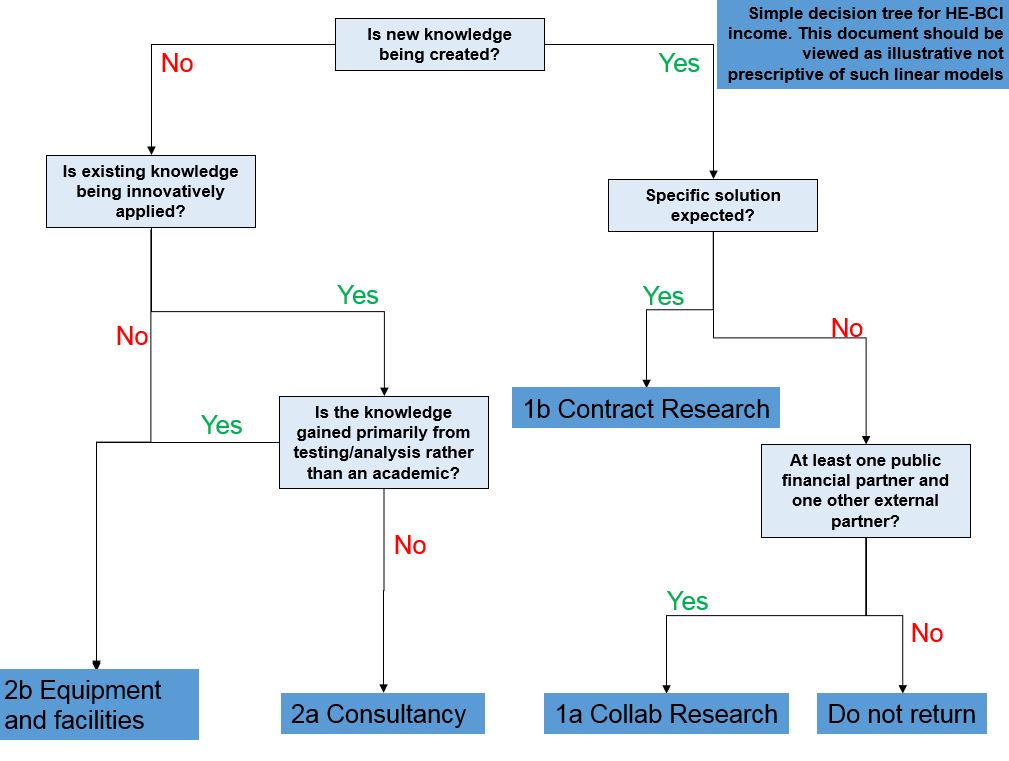

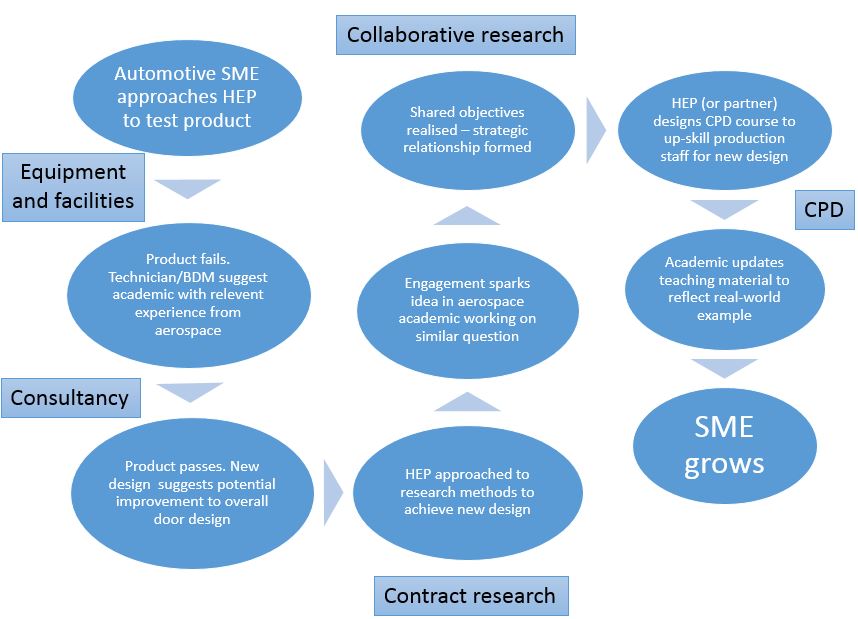

The diagrams below illustrate whether different categories of income can be returned and which table that they can be attributed to. These examples are illustrative and do not represent some of the more complex arrangements.

Flowchart 1

Flowchart 2

Need help?

Contact Liaison by email or on +44 (0)1242 388 531.