Finance record 2018/19 - Coverage of the record

Version 1.0 Produced 2019-09-20

- Purpose of the Finance record

- Scope of the Finance record

- Accounting conventions for the Finance record

- Discontinued/acquired operations

- Full economic costing (fEC)

- Conventions relating to research grants and contracts and other services rendered

- HESA Cost centres

- Uniformity of returns

- The ordering and linking of the tables

- Audit

- Date of return

Purpose of the Finance record

- The annual Finance record is the main source of historical financial information on the total activities of higher education providers (HEPs) in Scotland, Wales and Northern Ireland. The data supplied within the return are required for the following reasons:

- To assist in the production of management information.

- To assist in the monitoring of the financial health of HEPs.

- To support policy formulation and decisions.

- To support proper reporting and accountability.

- To inform and report on the funding process.

- To advise the Office for National Statistics (ONS) on the overseas earnings of HEPs for use in the calculation of the Balance of Payments.

- The UK funding councils intend to use data on research income within the Research Excellence Framework (REF). In particular income from charities will be disaggregated according to whether or not it was gained through an 'open competitive process'. It is therefore important that income from charities is split between that earned through 'open competitive process' and 'other income'.

- Based on these uses, it is important that the return should be completed as consistently as possible between one HEP and another and between successive years.

- The Finance record provides details of the consolidated statement of comprehensive income and expenditure, consolidated balance sheet, and consolidated statement of cash flows. The figures recorded in the Finance record must be the same as those recorded in the audited financial statements.

- All HEPs should prepare their annual financial statements in accordance with the 'Financial Reporting Standard 102' (FRS102) and the 'Statement of Recommended Practice: Accounting for Further and Higher Education' (SORP), and comply with the financial reporting requirements contained in any UK legislation relevant to their constitution, such as the Companies Act and the Charities Act.

- Tables 1-4 in the Finance record must reflect HEPs' audited financial statements.

- The remaining tables in the Finance record analyse the financial statements in greater detail than is required for published financial statements, and these notes of guidance provide further detail for this analysis. The principles of the SORP relating to the financial statements apply equally to the completion of the Finance record. In addition, conventions relating to discontinued/acquired operations, research grants and contracts, other services rendered and cost centres are set out and should also be followed by HEPs in preparing their returns.

- Although specific guidance exists for some income streams in the Finance record, where this becomes superseded by decisions taken in the financial statements by the HEP and their auditors, then the same principles underlying the auditors' decisions must be applied to the Finance record. The Finance record is a more detailed breakdown of the income and expenditure returned in the financial statements; the totals must match.

- Where a HEP's auditors' advice conflicts with the Finance record, then the HEP should inform HESA Liaison of the conflicting advice. Where this is material HESA will raise as an issue with BUFDG.

- The individual elements of income and expenditure relating to such operations should be included under the relevant individual Heads within the record.

- The implementation of full economic costing (fEC) should not have any impact on the way in which HEPs account for research income in their financial statements. fEC is a methodology by which a price is calculated and the only result is that the price, and hence income, should increase: the category of income remains the same, i.e. research grants and contracts. The costs of HEPs' activities remain as they would otherwise have been. On the face of the income and expenditure account the categories of staff costs, fundamental restructuring costs, other operating expenses, depreciation and interest, and other finance costs remain the same; for those HEPs that have disclosed the direct costs of research in the notes to the accounts, the same treatment is also appropriate.

- Research is to include research and experimental development. The definition of research, below, is taken from the 2015 Frascati Manual (ISBN: 9789264239012 - available from OECD via http://www.oecd-ilibrary.org/):

- Basic research is experimental or theoretical work undertaken primarily to acquire new knowledge of the underlying foundations of phenomena and observable facts, without any particular application or use in view. Applied research is original investigation undertaken in order to acquire new knowledge. It is, however, directed primarily towards a specific practical aim or objective. Experimental development is systematic work, drawing on knowledge gained from research, practical experience, and producing additional knowledge, which is directed to producing new products or processes or to improving existing products or processes.

- The Frascati Manual lists situations where certain activities are to be excluded from R&D except when carried out solely or primarily for the purposes of an R&D project. These include: routine testing and analysis of materials, components, products, processes, etc; feasibility studies; routine software development; general purpose data collection. The later stages of some clinical drug trials may be more akin to routine testing, particularly in cases where the original research has been done by a drug company or other contractor. For further details on the activities that should be excluded from R&D see Chapters 2.7 and 2.8 of the Frascati Manual.

- In some cases the classification between 'research grants and contracts' and 'other services rendered' may be borderline. In such situations, the Frascati Manual should be referred to in order to determine the correct classification.

- In Table 8 of the Finance record, expenditure on Head 6 (Research grants and contracts) and Head 7 (Other expenditure) should consist of direct costs which are incurred and should be identical to the audited financial statements.

- Tables 5 and 8 break down income and expenditure by HESA Cost Centre. A HESA Cost Centre, as used for Finance purposes, represents a group of operations having similar characteristics and broadly similar patterns of costs. Expenditure relating to administration and central services, such as libraries and computer centres, should be shown under academic services, whereas expenditure relating to units (such as animal houses or engineering workshops) servicing particular academic departments should normally be included under the associated academic cost centre. Central services have their own cost centre codes under Total Academic Services and Central administration and services. For example, where telephone costs are charged to departments they should be included in academic departmental expenditure under the appropriate cost centre. Postage costs should be similarly treated to the extent that the expenditure is charged to the academic department. The cost centre codes are the main references in the computerised record of recurrent expenditure. They are also included in the HESA Student and Staff returns and, therefore, provide the main link between the Finance and these other returns.

- It is imperative that the Finance record is completed uniformly, and so all HEPs should follow the notes of guidance available. This will then allow the data to be compiled in a consistent manner and for meaningful interpretations of the data to be made. All monies should be shown in units of £1,000 and where necessary be independently rounded to the nearest £1,000. For example, £147,700 should be entered as 148.

- Table 1 (Consolidated statement of comprehensive income and expenditure), the main heads of Table 3 (Consolidated balance sheet) and Table 4 (Consolidated statement of cash flows) must be identical to the audited/published financial statements.

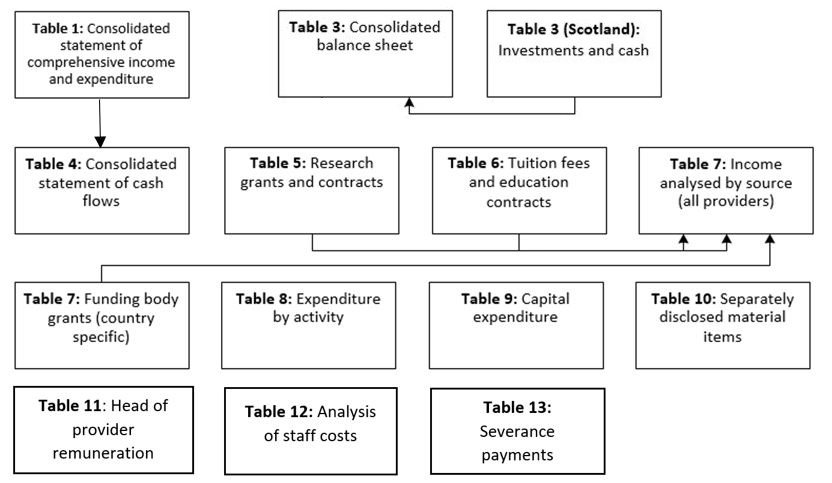

- Table 5 (Research grants and contracts - breakdown by source of income), Table 6 (Tuition fees and education contracts analysed by domicile, mode, level and source) and Table 7 Funding body grants (country specific) should be completed before Table 7 (Income analysed by source) as the totals from all of these tables are automatically entered into Table 7.

- The suggested order for completion of the tables is as numbered, see the below image which highlights how certain Tables link together:

- Figures in the template in black font contain formulas and are therefore automatically calculated. Figures that are in blue font require manual data input.

- There are a number of validation checks embedded in the template. In addition to these there are a number of other checks that will be undertaken as part of the verification and validation procedure. The details of these additional checks will be listed in the Exception stage quality rules and the Check documentation guide for the Finance record.

- The data returned are subject to audit but do not require an Audit Statement.

Scope of the Finance record

Accounting conventions for the Finance record

Conventions to be used in the Finance record

Discontinued/acquired operations

Full economic costing (fEC)

Conventions relating to research grants and contracts and other services rendered

"Research and experimental development (R&D) comprise creative and systematic work undertaken in order to increase the stock of knowledge, including knowledge of humankind, culture and society, and to devise new applications of available knowledge.

The term R&D covers three types of activity: basic research, applied research and experimental development."

HESA Cost centres

Uniformity of returns

The ordering and linking of the tables

Audit

Need help?

Contact Liaison by email or on +44 (0)1242 388 531.