HE-BCI record 2018/19 - General guidance on Table 1: Research related activities

Version 1.3 Produced 2019-11-22

Table 1 provides analysis of collaborative and contract research.

Head 1: Collaborative research involving public funding

- grant-in-aid from at least one public body, and

- a contribution (which may be cash or 'in-kind' if specified in the collaborative agreement and auditable) from at least one external non-academic collaborator.

The term 'non-academic organisation (collaborator)' should be understood to refer to charities, public and not-for-profit organisations as well as commercial business.

In-kind contributions should be ‘contractually explicit' i.e. the external partner should be aware of the financial values assumed for their contribution. In-kind contributions could for example include staff time, resources, materials, provision of data etc.

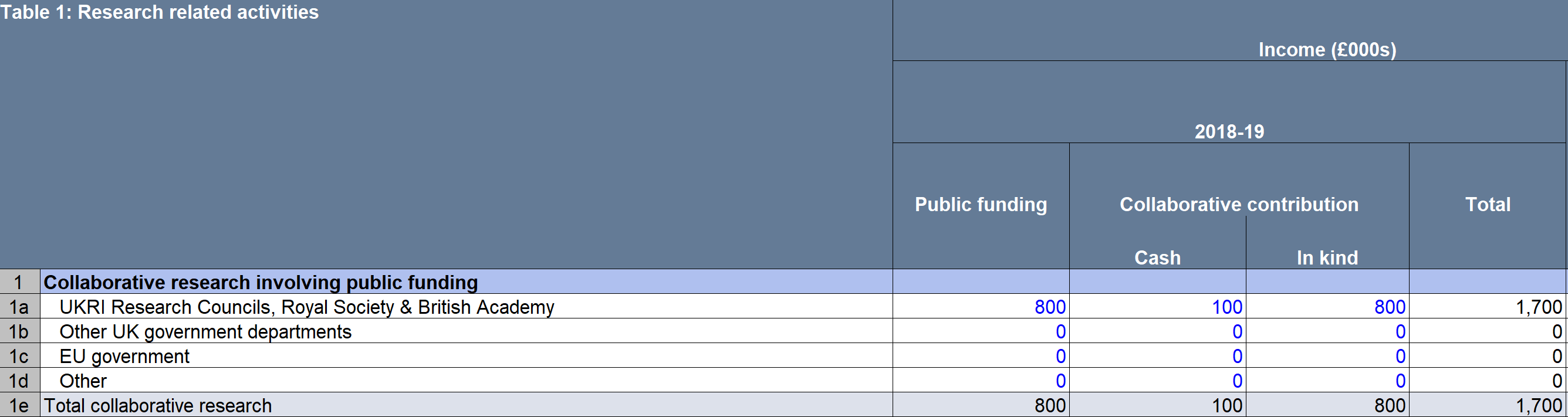

Example 1:

Collaborative multidisciplinary research centre

£350K ESRC research grant income

£450K BBSRC research grant income

International collaborating HEP

National Rail: £100K cash, data valued at £750K, secondment of staff to HEP £50K

Here the public body (National Rail) is acting as a project collaborator rather than as a sponsor. Contributions involving international collaborating HEP are not returned.

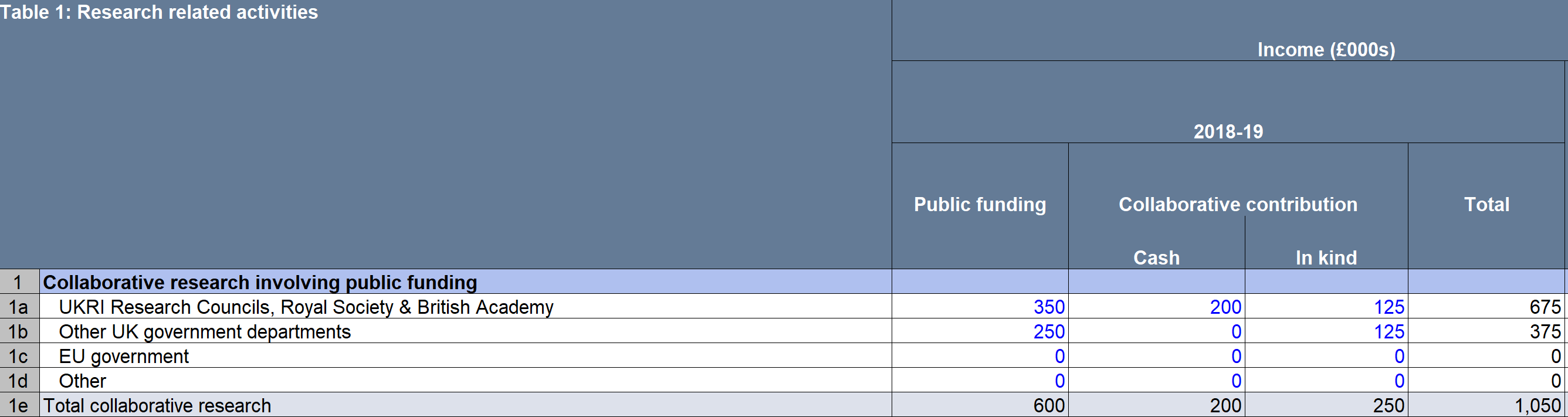

Example 2 (No clear lead funder):

No clear funder: Innovate UK collaborative R&D Project (one year duration) involving EPSRC, Innovate UK, 2 HEPs and 7 industry collaborators

£250K Innovate UK grant for collaborative R&D awarded to Big City University

£350K EPSRC research grant awarded to Big City University

£450K EPSRC research grant awarded to Campus College

£200K cash contribution from companies to Big City University

£300K cash contribution with £100k materials from companies to Campus College

£500K costs of project activities outside HEPs (described in collaboration agreement - apportioned equally)

Big City University

Campus College

Income should be returned in line with the audited/published financial statements. Income attributable to the record year should be returned, i.e. the whole value of a multiple year grant should not be returned in the year it was awarded but apportioned over the years as required. While these data are available elsewhere, KTPs and CASE awards are central to many HEPs' KT strategy and therefore should be included.

Sub-head 1a: UKRI Research Councils, Royal Society & British Academy

- Biotechnology and Biological Sciences Research Council (BBSRC)

- Natural Environment Research Council (NERC)

- Engineering and Physical Sciences Research Council (EPSRC)

- Economic and Social Research Council (ESRC)

- Science and Technology Facilities Council (STFC)

- Medical Research Council (MRC)

- Arts and Humanities Research Council (AHRC)

Sub-head 1b: Other UK Government departments

Sub-head 1c: EU Government

Sub-head 1d: Other

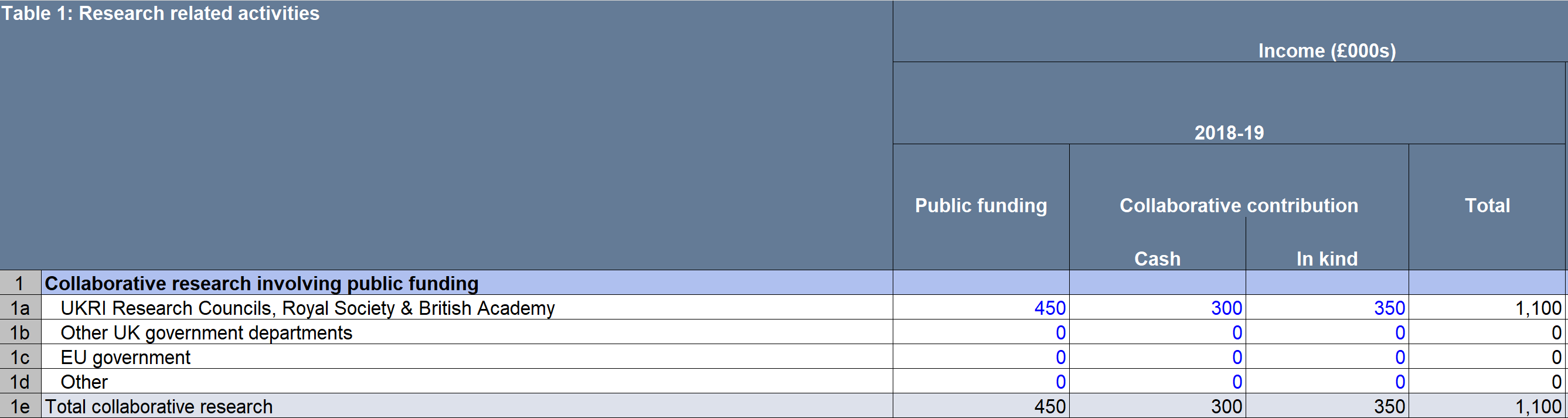

Example 1:

Lead funder: Arts Council England

Collaborative partner: British Museum

Project: Research into the transformation of Museum activities in the UK

Contribution from Arts Council England: £60K

Contribution from British Museum: £20K in kind contribution

Return: If the money that was received from Arts Council England, was sourced from government public funds, return the £60k in 1d 'Other' and 'public funding' and collaborative contribution of £20k from the British Museum under 1d 'Other' and 'in kind contribution' . If the Lead funder's contribution was sourced from non-public funding e.g. lottery funding, do not return.

Head 2: Contract Research (excluding any already returned in Head 1 and research councils)

- employ fewer than 250 employees worldwide (including partners and executive directors), and

- has either an annual turnover not exceeding 50m euros, or an annual balance sheet total not exceeding 43m euros, and

- conforms to the following independence criteria:

An enterprise is considered independent unless 25% or more of the capital or of the voting rights is owned by an enterprise falling outside the definition of an SME whichever may apply, or jointly by several such enterprises. (This ceiling may be exceeded if the enterprise is held by public investment corporations, venture capital companies or organisational investors, provided no control is exercised either individually or jointly, or if the capital is spread in such a way that it is not possible to determine by whom it is held).

SMEs include micro, small and medium enterprises, and sole traders.

Example 1:

Client: BBSRC

Project: Research and profile previous BBSRC grants and their effectiveness and recommend improvements to impact of funding

Contribution: £50K

Return: As £50K under Sub-head 2f Total value with non-commercial organisations.

Example 2:

Client: BBSRC

Project: Mapping a genome

Contribution: N/A

Do not return: This is basic research and not relevant for the HE-BCI record as grants for research that do not meet the specific research needs of an external partner should not be returned.

Example 3:

Client: Research Council

Project: Any responsive mode grant

Contribution: N/A

Do not return: It is likely that most responsive mode grants are part of the core research funding arena and should not be returned.

Example 4:

Client: Large environmental company

Project: Research into engaging service providers in pro-environmental behaviours and development of training and education toolkits, undertaken in partnership with two large sector specialist training providers.

Contribution: £25K

Return: Return 1 under Sub-head 2c Number with other (non-SME) commercial businesses and £25k under 2d Total value with other (non-SME) commercial businesses.

Need help?

Contact Liaison by email or on +44 (0)1242 388 531.