HE-BCI record 2020/21 - General guidance on Table 1: Research related activities

Version 1.1 Produced 2022-03-04

Table 1 provides analysis of collaborative and contract research.

Head 1: Collaborative research involving public funding

Income should be returned for research projects which have public sponsorship (grant in aid from a government or public body) to support research performed in collaboration with at least one other non-academic organisation (collaborator). Collaborative research with other HEPs should not be included. In the context of collaborative research, it is the collaboration rather than the nature of the research that is of primary importance. 'Collaborative research' must involve:

- grant-in-aid from at least one public body, and

- a contribution (which may be cash or 'in-kind' if specified in the collaborative agreement and auditable) from at least one external non-academic collaborator.

The term 'non-academic organisation (collaborator)' should be understood to refer to charities, public and not-for-profit organisations as well as commercial business.

In-kind contributions should be ‘contractually explicit' i.e. the external partner should be aware of the financial values assumed for their contribution. In-kind contributions could for example include staff time, resources, materials, provision of data etc.

Collaborative research projects can involve complex financial arrangements - particularly where there are a number of organisations that are contributing and/or using resources. This record aims to capture the direct income to the HEP - both grant-in-aid from the public sponsor, as well as any direct financial contribution from collaborators. In-kind contributions include contributions to the project from the non-academic collaborators (for example staff time, use of equipment and other resources, materials, provision of data etc.) as described in the project collaboration agreement. Where the in-kind contributions cannot be attributed to a specific HEP (for example where there are multiple HEPs) the costs should be apportioned and care must be taken to avoid "double counting". Whilst it is recognised that in-kind contributions are difficult to capture systematically, only in-kind contributions that have been formally recorded, for example on Finance or Research Project Management Systems, should be returned. (By formally recorded it is meant recorded in a way that is clear, transparent and that would stand up to audit.)

Where a consortium of providers are receiving a benefit from in-kind contributions that are shared between multiple HEPs in the UK and overseas, it should be shared across all partners irrelevant of location so that the UK partners are showing a truer share.

Where there is a clear lead funder projects should be returned under one subheading depending upon the body the primary funder falls under, e.g. EU Government. If there is not clear lead funder projects should be split as appropriate between the subheadings the funders fall under.

Where projects involve 'grant in aid' from more than one public sponsor the direct contributions should be shown against each sponsor category (e.g. research councils and government departments). The cash and in-kind contributions from collaborators should be apportioned between these public funders; dependent on the circumstances it is acceptable to assign all cash/in-kind contributions to a single public sponsor, split equally or apportion pro-rata.

There is not currently a category within HE-BCI to return funding from cross UKRI programmes such as the Strength in Places Fund (SIPF). This will be addressed through a major review of the record, however, providers are advised in the meantime to return any income from SIPF or similar cross UKRI funding under the 1a 'UKRI Research Councils, Royal Society and British Academy' category in Table 1, providing the income meets the requirements for collaborative research.

In returning the SIPF funding, providers should ensure that where funding has been allocated to a SIPF project that involves a number of HEP partners that income is not double counted, and that either the lead HEP partner includes all the funding or HEP partners each only include the amount of funding passed to them.

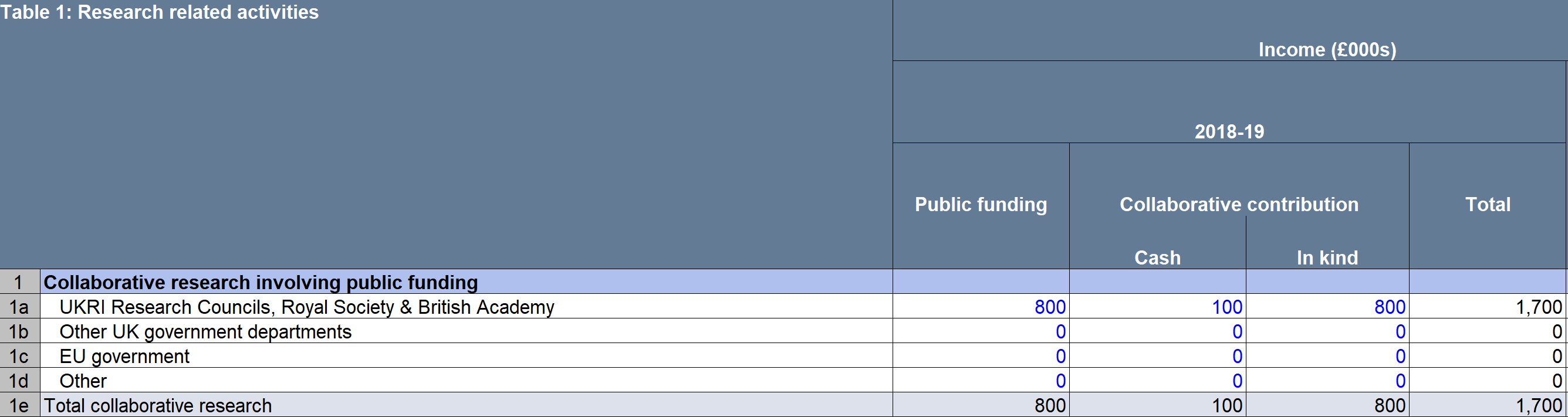

Example 1:

Collaborative multidisciplinary research centre

£350K ESRC research grant income

£450K BBSRC research grant income

International collaborating HEP

National Rail: £100K cash, data valued at £750K, secondment of staff to HEP £50K

Here the public body (National Rail) is acting as a project collaborator rather than as a sponsor. Contributions involving international collaborating HEP are not returned.

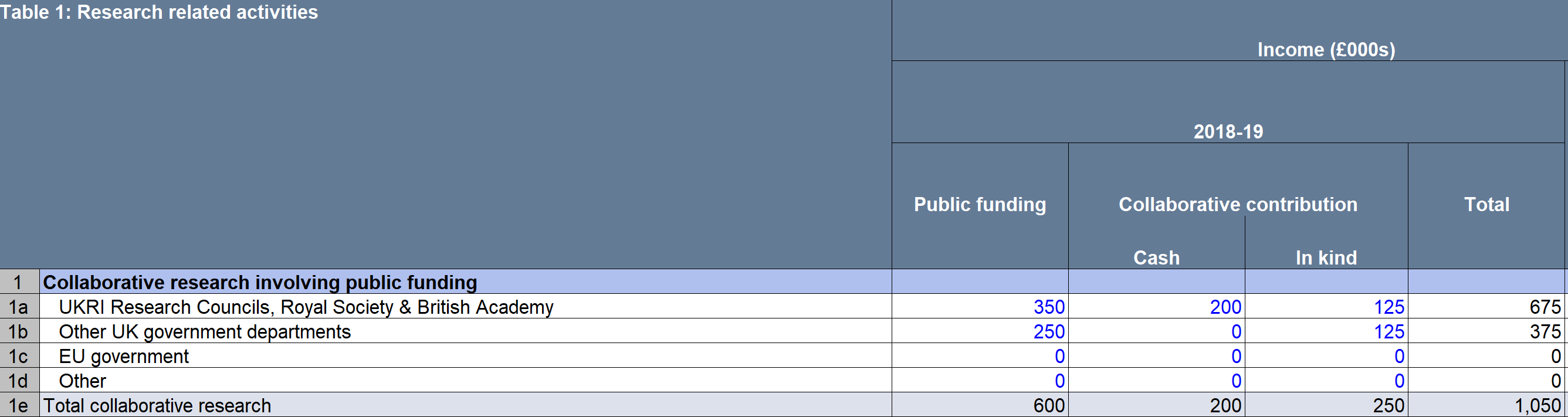

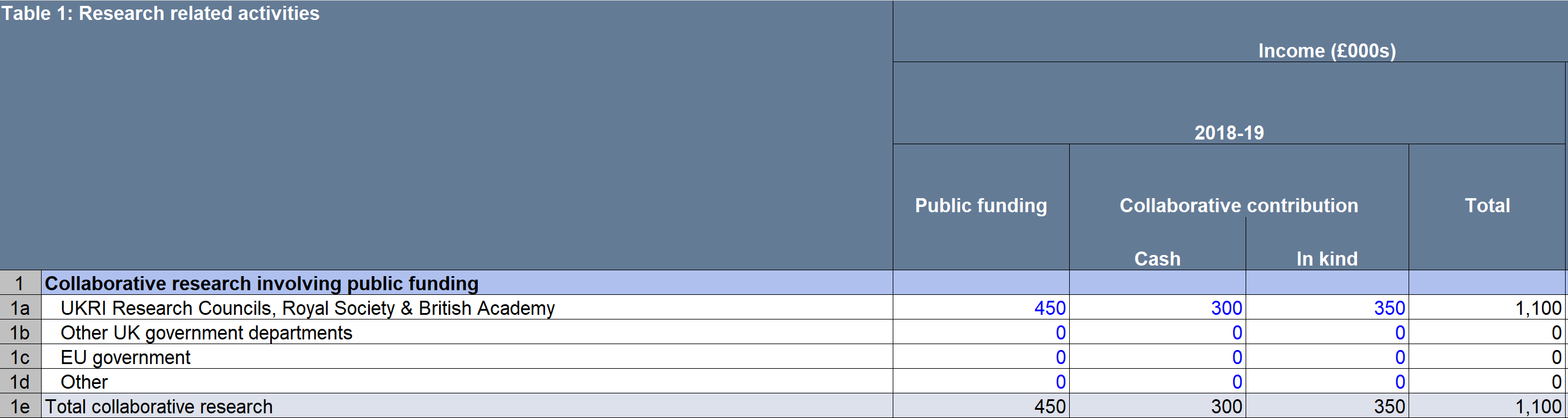

Example 2 (No clear lead funder):

No clear funder: Innovate UK collaborative R&D Project (one year duration) involving EPSRC, Innovate UK, 2 HEPs and 7 industry collaborators

£250K Innovate UK grant for collaborative R&D awarded to Big City University

£350K EPSRC research grant awarded to Big City University

£450K EPSRC research grant awarded to Campus College

£200K cash contribution from companies to Big City University

£300K cash contribution with £100k materials from companies to Campus College

£500K costs of project activities outside HEPs (described in collaboration agreement - apportioned equally)

Big City University

Campus College

Income should be returned in line with the audited/published financial statements. Income attributable to the record year should be returned, i.e. the whole value of a multiple year grant should not be returned in the year it was awarded but apportioned over the years as required. While these data are available elsewhere, KTPs and CASE awards are central to many HEPs' KT strategy and therefore should be included.

Sub-head 1a: UKRI Research Councils, Royal Society & British Academy

Should include all collaborative research income from research councils covered by the UK Research and Innovation. They are:

- Biotechnology and Biological Sciences Research Council (BBSRC)

- Natural Environment Research Council (NERC)

- Engineering and Physical Sciences Research Council (EPSRC)

- Economic and Social Research Council (ESRC)

- Science and Technology Facilities Council (STFC)

- Medical Research Council (MRC)

- Arts and Humanities Research Council (AHRC)

Research income from the British Academy and the Royal Society should also be included in this row.

Further information on collaborative research undertaken by the UKRI can be found at the UKRI website.

Any additional funding received as a covid-19 extension to existing grants should be reported to HE-BCI in the same way as the original grant award.

Sub-head 1b: Other UK Government departments

Income from all government departments and Innovate UK(including income from Knowledge Transfer Partnerships (KTPs)) should be included under this sub-head.

Sub-head 1c: EU Government

This sub-head should include all research income from all government bodies operating in the EU, which includes the European Commission but excludes bodies in the UK.

Sub-head 1d: Other

This sub-heading should include all 'other organisations' who are distributing public funds. Other forms of collaborative research involving public funding could include charities, public and not-for-profit organisations as well as commercial business. 'Not for profit' describes non-profit organisations, which are mainly charities but there are other examples where organisations are neither public service nor private business but can't or don't become formal charities. See the Charity Comission website for details of all registered charities in England and Wales. Charity Commission for Northern Ireland and OSCR (Scottish Charity Regulator). This Sub-head can include non-EU funding and charities who are not registered in the UK.

Example 1:

Lead funder: Arts Council England

Collaborative partner: British Museum

Project: Research into the transformation of Museum activities in the UK

Contribution from Arts Council England: £60K

Contribution from British Museum: £20K in kind contribution

Return: If the money that was received from Arts Council England, was sourced from government public funds, return the £60k in 1d 'Other' and 'public funding' and collaborative contribution of £20k from the British Museum under 1d 'Other' and 'in kind contribution' . If the Lead funder's contribution was sourced from non-public funding e.g. lottery funding, do not return.

Please note that the European Space Agency should be classified as ‘Other’ rather than as European government.

Head 2: Contract Research (excluding any already returned in Head 1 and research councils)

Head 2 should be used to return specific contract research. Income returned under Head 2 must be identifiable as the HEP meeting the specific research needs of external partners. Income must align with the accounting policies adopted by the provider, i.e. in a year in which the financial accounts recorded that a provider received contract research income, it should be returned in the corresponding HE-BCI submission.

Awards and grants made for proposals from the HEP should not be returned in Table 1. In particular, basic research council grants should not be returned as contract research.

SMEs are classified as enterprises which:

- employ fewer than 250 employees worldwide (including partners and executive directors), and

- has either an annual turnover not exceeding 50m euros, or an annual balance sheet total not exceeding 43m euros, and

- conforms to the following independence criteria:

An enterprise is considered independent unless 25% or more of the capital or of the voting rights is owned by an enterprise falling outside the definition of an SME whichever may apply, or jointly by several such enterprises. (This ceiling may be exceeded if the enterprise is held by public investment corporations, venture capital companies or organisational investors, provided no control is exercised either individually or jointly, or if the capital is spread in such a way that it is not possible to determine by whom it is held).

SMEs include micro, small and medium enterprises, and sole traders. See the Coverage of the record for further details on definitions.

Income from commercial and non-commercial organisations for contract research may include various projects relating to both subjects and non-STEM subjects.

Contract research income from charities can be included under Head 2 where the charity is contracting research for its own purposes.

Example 1:

Client: BBSRC

Project: Research and profile previous BBSRC grants and their effectiveness and recommend improvements to impact of funding

Contribution: £50K

Return: As £50K under Sub-head 2f Total value with non-commercial organisations.

Example 2:

Client: BBSRC

Project: Mapping a genome

Contribution: N/A

Do not return: This is basic research and not relevant for the HE-BCI record as grants for research that do not meet the specific research needs of an external partner should not be returned.

Example 3:

Client: Research Council

Project: Any responsive mode grant

Contribution: N/A

Do not return: It is likely that most responsive mode grants are part of the core research funding arena and should not be returned.

The National Institute for Health Research (NIHR) should be treated in the same way as a research council.

Example 4:

Client: Large environmental company

Project: Research into engaging service providers in pro-environmental behaviours and development of training and education toolkits, undertaken in partnership with two large sector specialist training providers.

Contribution: £25K

Return: Return 1 under Sub-head 2c Number with other (non-SME) commercial businesses and £25k under 2d Total value with other (non-SME) commercial businesses.

Need help?

Contact Liaison by email or on +44 (0)1242 388 531.