Income of Higher Education Institutions £26.8 billion in 2009/10

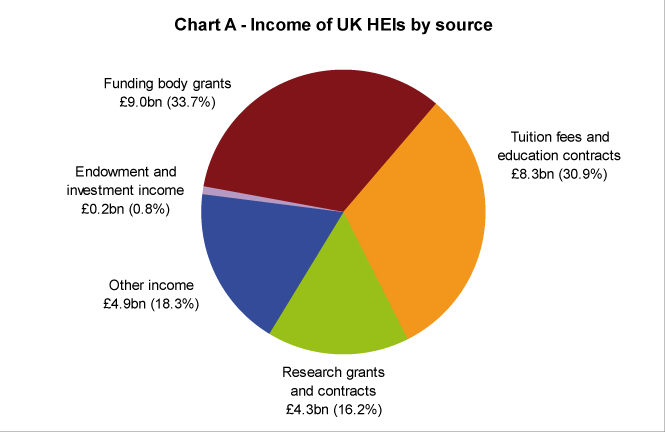

The newly released HE Finance Plus 2009/10 downloadable publication from HESA shows that the total income of higher education institutions (HEIs) last year was £26.8 billion. Funding bodies provided £9.0 billion of this income, while tuition fees and education contracts contributed £8.3 billion.

Chart A below shows the proportions of total income of UK higher education institutions by source in 2009/10:

The different sources are further broken down in Table 1 below. The recurrent teaching and research grants account for most of the funding body income at £5.8 billion and £2.0 billion respectively.

Income from home and EU domicile students’ course fees was £5.1 billion – 19.1% of the total income for UK HEIs. Non-EU students’ course fees totalled £2.6 billion in 2009/10 accounting for 9.6% of total income.

The Research Councils, The Royal Society, British Academy and The Royal Society of Edinburgh together contributed the largest portion of research grant and contract income. Research grants and contracts from non-UK sources contributed £741 million (2.8%) to the total income of UK HEIs.

Residences and catering operations added a further £1.5 billion to the income of HEIs while investment and endowment income added a further £219 million.

| Table 1. Sources of income for UK HEIs 2009/10 (£thousands) | ||||

|---|---|---|---|---|

| Source | Income | % of total income | ||

| Funding body grants | 9,043,115 | 33.7% | ||

| Recurrent (teaching) | 5,801,688 | 21.7% | ||

| Recurrent (research) | 1,974,548 | 7.4% | ||

| Recurrent - other (including special funding) | 775,752 | 2.9% | ||

| Release of deferred capital grants - buildings | 237,889 | 0.9% | ||

| Release of deferred capital grants - equipment | 150,174 | 0.6% | ||

| Grants for FE provision (not applicable to SFC) | 103,064 | 0.4% | ||

| Tuition fees and education contracts | 8,272,137 | 30.9% | ||

| Home and EU domicile students course fees | 5,119,622 | 19.1% | ||

| Non-EU domicile students course fees** | 2,580,008 | 9.6% | ||

| Non-credit-bearing course fees | 368,575 | 1.4% | ||

| FE course fees | 46,611 | 0.2% | ||

| Research training support grants | 157,321 | 0.6% | ||

| Research grants and contracts | 4,345,421 | 16.2% | ||

| BIS Research Councils, The Royal Society, British Academy and The Royal Society of Edinburgh | 1,585,357 | 5.9% | ||

| UK-based charities | 917,141 | 3.4% | ||

| UK central government bodies/local authorities, health and hospital authorities | 779,563 | 2.9% | ||

| UK industry, commerce and public corporations | 279,706 | 1.0% | ||

| EU Sources | 452,505 | 1.7% | ||

| Non-EU sources | 288,930 | 1.1% | ||

| Other sources | 42,219 | 0.2% | ||

| Other income | 4,915,913 | 18.3% | ||

| Other services rendered | 1,642,183 | 6.1% | ||

| Residences and catering operations (including conferences) | 1,488,783 | 5.6% | ||

| Grants from local authorities | 9,089 | 0.0% | ||

| Income from health and hospital authorities (excluding teaching contracts for student provision) | 373,761 | 1.4% | ||

| Release of deferred capital grants | 120,994 | 0.5% | ||

| Income from intellectual property rights | 43,461 | 0.2% | ||

| Other operating income | 1,237,642 | 4.6% | ||

| Endowment and investment income | 219,201 | 0.8% | ||

| Total income* | 26,795,787 | 100.0% | ||

| Source: HESA HE Finance Plus 2009/10 | ||||

| * Includes income from joint ventures. | ||||

| ** See Annex below for non-EU course fees by location of institution | ||||

Table 2 shows the changes in income from the major sources from the previous year. Income from tuition fees increased by 13.4% while endowment and investment income fell by 39.0%.

| Table 2. Sources of income for UK HEIs 2008/09 and 2009/10 (£thousands) | |||

|---|---|---|---|

| 2008/09 | 2009/10 | % change | |

| Funding body grants | 8,822,101 | 9,043,115 | 2.5% |

| Tuition fees and education contracts | 7,292,848 | 8,272,137 | 13.4% |

| Research grants and contracts | 4,148,880 | 4,345,421 | 4.7% |

| Other income | 4,748,982 | 4,915,913 | 3.5% |

| Endowment and investment income | 359,107 | 219,201 | -39.0% |

| Total Income* | 25,371,918 | 26,795,787 | 5.6% |

| Source: HESA HE Finance Plus 2009/10. See Annex below for England, Wales, Scotland and Northern Ireland figures | |||

| * Includes income from joint ventures. | |||

Expenditure £25.9 billion

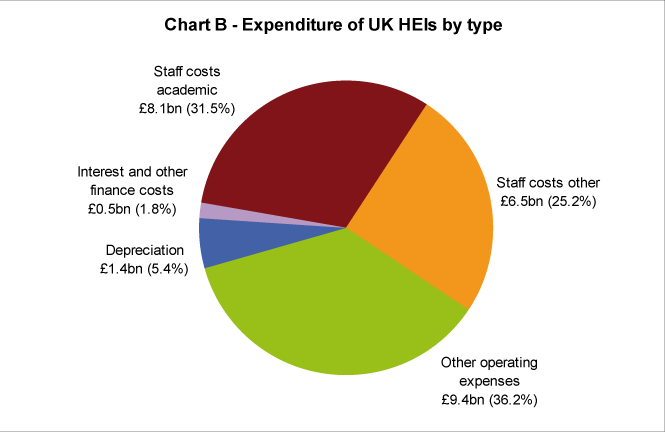

Total expenditure of UK HEIs in 2009/10 was £25.9 billion. Staff costs contributed £14.6 billion towards this total. Chart B below shows the total expenditure of UK higher education institutions by type in 2009/10:

Table 3 shows the changes in expenditure for the major types from the previous year. While overall expenditure only increased by 3.7%, expenditure on interest and other finance costs increased by 17.6%

| Table 3. Expenditure by type for UK HEIs 2008/09 and 2009/10 (£thousands) | |||

|---|---|---|---|

| 2008/09 | 2009/10 | % change | |

| Staff costs | 14,169,005 | 14,642,901 | 3.3% |

| Other operating expenses | 9,084,629 | 9,363,684 | 3.1% |

| Depreciation | 1,300,243 | 1,396,584 | 7.4% |

| Interest and other finance costs | 385,430 | 453,204 | 17.6% |

| Total Expenditure | 24,939,307 | 25,856,373 | 3.7% |

| Source: HESA HE Finance Plus 2009/10. See Annex below for England, Wales, Scotland and Northern Ireland figures | |||

HE Finance Plus 2009/10

HE Finance Plus 2009/10 includes finance data broken down to institutional level including tuition fees and education contracts, balance sheets, cash flow, capital expenditure, financial profiles and more. HE Finance Plus 2009/10 is available to purchase and instantly download from our website.

A new HESA product, Finances of Higher Education Institutions, containing a subset of the HESA finance collection will be published in May. Results of the 2009/10 HE Business and Community Interaction Survey will be published in June. A full schedule of all HESA releases for 2011 can be found here.

Notes for editors

- Press enquiries should be directed to:

- HESA Press Office

01242 211120

[email protected]

95 Promenade, Cheltenham, GL50 1HZ.

- HESA Press Office

- Data in the tables represent cash figures and are not adjusted for inflation.

- Values in Charts A and B are shown rounded to the nearest £0.1 billion. The sum of these values may not match the total values given in the text. Percentages in all Tables and Charts are shown rounded to one decimal place and may not sum to 100%.

- HESA Finance data is collected from all publicly funded Higher Education Institutions (HEIs) in the UK, plus the University of Buckingham, which is a non-publicly-funded institution. The 2009/10 data covers 165 HEIs (130 in England, 12 in Wales, 19 in Scotland and 4 in Northern Ireland).

- Where comparisons are made between the latest financial year (2009/10) and the previous year (2008/09), the previous year’s figures are those reported in the re-stated financial statements.

- The data in this release relates to all UK HE institutions. Figures for the individual nations of the UK are available in the Annex below: England; Wales; Scotland; Northern Ireland; Non-EU domicile students' course fees

- HESA cannot accept responsibility for any inferences or conclusions derived from the data by third parties.

- Definitions of the terms used above follow:

Definitions

Reference dates 2009/10

Financial data relates to the institutions' financial year, i.e. 1 August 2009 to 31 July 2010.

Reference dates 2008/09

Financial data relates to the institutions' financial year, i.e. 1 August 2008 to 31 July 2009.

Sources of income

Funding body grants include those from the Higher Education Funding Council for England (HEFCE), the Higher Education Funding Council for Wales (HEFCW), the Scottish Further and Higher Education Funding Council (SFC), the Department for Employment and Learning Northern Ireland (DEL(NI)), the Training and Development Agency for Schools (TDA) and the Skills Funding Agency (SFA).

Tuition fees & education contracts includes all income received in respect of fees for students on all courses for which fees are charged.

Research grants & contracts includes all income in respect of externally sponsored research carried out by the institution or its subsidiary undertaking for which directly related expenditure has been incurred.

Other income - other services rendered includes all income in respect of services rendered to outside bodies, including the supply of goods and consultancies.

Endowment and investment income includes income from specific endowment asset investments, general endowment asset investments, other investment income and other interest receivable.

Categories of expenditure

Staff costs covers all, and only, those full-time and part-time staff who have a contract of employment with the institution and includes any redundancy or restructuring payments (that are not treated as exceptional items) made to these staff.

Other operating expenses includes costs in respect of payments to non-contracted staff or individuals, all other non-staff costs incurred, except for depreciation and interest payable. Equipment that has not been capitalised, expenditure on maintenance contracts and telephone costs (calls, rental and non-capitalised equipment) are also included in this category.

Depreciation includes depreciation costs on equipment.

Interest and other finance costs includes costs in respect of interest payable on premises, residences and catering operations (including conferences) and other expenditure. This heading also includes Pension Cost adjustments in accordance with Financial Reporting Standard 17.

Ends

Annex - equivalent tables for England, Wales, Scotland and Northern Ireland

England

| Sources of income for HEIs in England 2008/09 and 2009/10 (£thousands) | |||

|---|---|---|---|

| 2008/09 | 2009/10 | % change | |

| Funding body grants | 7,099,956 | 7,280,128 | 2.5% |

| Tuition fees and education contracts | 6,286,180 | 7,142,075 | 13.6% |

| Research grants and contracts | 3,340,849 | 3,499,088 | 4.7% |

| Other income | 4,002,472 | 4,134,377 | 3.3% |

| Endowment and investment income | 296,096 | 179,531 | -39.4% |

| Total Income* | 21,025,553 | 22,235,199 | 5.8% |

| * Includes income from joint ventures. Total income may not equal sum of rows - see note 3 | |||

| Expenditure by type for HEIs in England 2008/09 and 2009/10 (£thousands) | |||

|---|---|---|---|

| 2008/09 | 2009/10 | % change | |

| Staff costs | 11,664,396 | 12,073,096 | 3.5% |

| Other operating expenses | 7,558,712 | 7,777,198 | 2.9% |

| Depreciation | 1,086,282 | 1,167,709 | 7.5% |

| Interest and other finance costs | 338,834 | 398,210 | 17.5% |

| Total Expenditure | 20,648,224 | 21,416,213 | 3.7% |

| Source: HESA HE Finance Plus 2009/10 | |||

Wales

| Sources of income for HEIs in Wales 2008/09 and 2009/10 (£thousands) | |||

|---|---|---|---|

| 2008/09 | 2009/10 | % change | |

| Funding body grants | 440,375 | 453,895 | 3.1% |

| Tuition fees and education contracts | 337,734 | 378,957 | 12.2% |

| Research grants and contracts | 156,561 | 155,635 | -0.6% |

| Other income | 223,246 | 240,580 | 7.8% |

| Endowment and investment income | 13,628 | 6,623 | -51.4% |

| Total Income* | 1,171,544 | 1,235,690 | 5.5% |

| * Includes income from joint ventures. | |||

| Expenditure by type for HEIs in Wales 2008/09 and 2009/10 (£thousands) | |||

|---|---|---|---|

| 2008/09 | 2009/10 | % change | |

| Staff costs | 686,120 | 709,177 | 3.4% |

| Other operating expenses | 396,385 | 417,415 | 5.3% |

| Depreciation | 51,071 | 53,357 | 4.5% |

| Interest and other finance costs | 15,815 | 19,565 | 23.7% |

| Total Expenditure | 1,149,391 | 1,199,514 | 4.4% |

| Source: HESA HE Finance Plus 2009/10 | |||

Scotland

| Sources of income for HEIs in Scotland 2008/09 and 2009/10 (£thousands) | |||

|---|---|---|---|

| 2008/09 | 2009/10 | % change | |

| Funding body grants | 1,067,943 | 1,099,550 | 3.0% |

| Tuition fees and education contracts | 557,658 | 627,808 | 12.6% |

| Research grants and contracts | 571,198 | 601,314 | 5.3% |

| Other income | 426,312 | 448,458 | 5.2% |

| Endowment and investment income | 40,420 | 26,808 | -33.7% |

| Total Income* | 2,663,531 | 2,803,938 | 5.3% |

| * Includes income from joint ventures. | |||

| Expenditure by type for HEIs in Scotland 2008/09 and 2009/10 (£thousands) | |||

|---|---|---|---|

| 2008/09 | 2009/10 | % change | |

| Staff costs | 1,528,037 | 1,564,878 | 2.4% |

| Other operating expenses | 953,535 | 1,002,213 | 5.1% |

| Depreciation | 131,758 | 148,584 | 12.8% |

| Interest and other finance costs | 24,444 | 26,335 | 7.7% |

| Total Expenditure | 2,637,774 | 2,742,010 | 4.0% |

| Source: HESA HE Finance Plus 2009/10 | |||

Northern Ireland

| Sources of income for HEIs in Northern Ireland 2008/09 and 2009/10 (£thousands) | |||

|---|---|---|---|

| 2008/09 | 2009/10 | % change | |

| Funding body grants | 213,827 | 209,542 | -2.0% |

| Tuition fees and education contracts | 111,276 | 123,297 | 10.8% |

| Research grants and contracts | 80,272 | 89,384 | 11.4% |

| Other income | 96,952 | 92,498 | -4.6% |

| Endowment and investment income | 8,963 | 6,239 | -30.4% |

| Total Income* | 511,290 | 520,960 | 1.9% |

| * Includes income from joint ventures. | |||

| Expenditure by type for HEIs in Northern Ireland 2008/09 and 2009/10 (£thousands) | |||

|---|---|---|---|

| 2008/09 | 2009/10 | % change | |

| Staff costs | 290,452 | 295,750 | 1.8% |

| Other operating expenses | 175,997 | 166,858 | -5.2% |

| Depreciation | 31,132 | 26,934 | -13.5% |

| Interest and other finance costs | 6,337 | 9,094 | 43.5% |

| Total Expenditure | 503,918 | 498,636 | -1.0% |

| Source: HESA HE Finance Plus 2009/10 | |||

Non-EU domicile students’ course fees

| Income from non-EU domicile students' course fees by location of institution | |||

|---|---|---|---|

| Location of institution | Non-EU domicile students' course fees | % of total income | |

| England | 2,220,204 | 10.0% | |

| Wales | 87,248 | 7.1% | |

| Scotland | 261,142 | 9.3% | |

| Northern Ireland | 11,414 | 2.2% | |

| United Kingdom | 2,580,008 | 9.6% | |

| Source: HESA HE Finance Plus 2009/10 | |||

Press Officer