Finance 2017/18: Support guides

This page provides an overview of the 2017/18 Finance collection (C17031).

This should be used alongside the C17031 coding manual, which provides more detailed, technical information about the collection.

Need help? Contact us by email or on +44 (0)1242 211144

Finance record overview

We collect data across a number of streams. These streams focus on different aspects of higher education.

The Finance stream collects financial information on the activities of Northern Irish, Welsh and Scottish higher education providers. Details of what information needs to be returned to HESA are included in the Coverage document found in the Coding manual.

The data we collect on behalf of the sector is provided to governments and funding bodies in order to support the regulation of higher education. We also make data available to the public to enhance understanding of UK higher education and to support its advancement.

Our coding manuals provide you with all the necessary documentation to support your data return. The coding manual contains technical documents giving detailed information on the record's coverage, data specification and submission formats. Familiarising yourself with these documents will help you make an accurate and timely return.

Each collection has its own coding manual which can be found in the Data collection section of our site. By default, you will land on the open collection for each record; you can then select previous or future years.

The coding manuals will be updated throughout the data collection cycle and Record Contacts informed by email when new versions are made live. Be sure to check the manual's Revision history for a summary of changes.

You submit data via our Data Collection system. To access this, you will need to have an appropriate role in our Identity System (IDS). We publish an IDS user guide which includes information on creating and editing your account.

You will need to be given access to the Data Collection system by the relevant Record Contact at your provider.

Once you have access to the system you will be able to upload files and track the progress of the collection.

The coding manual homepage includes all the technical information you require, including:

- The data specification

- File format specifications

- A detailed collection schedule

- Our XML data entry tool (available for some streams)

- Quality rules.

This Support guides page collects together the following resources:

- User guide

- Data collection system: Known issues and release history.

In the Support area of the HESA website, you can find:

- User guides for our Identity System (IDS) and Issue Management System data quality database (HESA subscribers only).

- Support with using XML files

- Our XML amalgamator tool and Validation kits available for some collections.

Our Data innovation section includes information about:

- Open and recently completed record reviews, including information about changes we are implementing

- Our Data Futures programme which will transform the higher education information landscape.

In the About section, you can find:

- Details of who we are and what we do

- Information about data protection

- Information for providers including the Code of practice for HE data collections, and information about subscription rates and the fixed database facility.

Our expert analysts have a thorough understanding of our records and processes. We are here to support you throughout the data submission process.

Please note the phone number for the Liaison team: +44(0)1242 388531.

Our JISCMail groups allow you to discuss specific streams with colleagues from across the sector.

Data collection system: Release history and known issues

| Issue summary | Status | Date raised | Date resolved |

|---|---|---|---|

|

Issue ID: 68384 - QR.Table11.5 triggers incorrectly (timestamp issue) QR.Table11.5 is triggering incorrectly in some circumstances. The rule states that if a head of provider's start date is after 31 July 2017 then Total remuneration for year ended 31 July 2017 should be zero. However, the rule can be triggered even where the start date is before 31 July 2017. As with issue ID 67760 below, this is due to an issue with the formatting of the timestamp and can be rectified by clicking in the cell and pressing 'enter' while HESA works on a permanent fix. |

Open | 14 December 2018 | |

|

Issue ID: 68005 - Bug with template validation rule Table11.7 Current template validation triggers in Table 11 where Head 8 = 'Yes' and Head 3c = '0', but unfortunately this is incorrect. Rather than re-releasing a new version of the template, HESA will implement a new exception rule which will trigger in your Quality Rules report in the Data Collection System. This will trigger where Head 8 = 'Yes' and Head 4b is less than or equal to '0'. **Note: If Table11.7 triggers in your template and Quality Rules page, please disregard this and instead focus on any other warnings which may have triggered.** |

Closed | 27 November 2018 |

14 December 2018 (Note that template validation could still trigger) |

|

Issue ID: 68004 - Table3S.5 The Scottish Funding Council have advised that it is permissable for Scottish providers to return zero under Heads 1f or 2f in Table_3_Scotland. However, as the collection is already underway, this error will continue to exist for C17031 (which will therefore require a switch to be requested and approved), and will be downgraded to a warning ahead of C18031. |

Open | 26 November 2018 | |

|

Issue ID: 67760 - Free text cells not populating in converted template In the converted template, the cells containing free text are not currently populating. This means that these cells will need to be manually re-entered. |

Closed | 21 November 2018 | 22 November 2018 |

|

Issue ID: 67760 - Date formatted incorrectly in Table 11 In the converted template, the cells containing date values in Table 11 are currently formatted wrongly. This can be rectified by simply clicking in the cell and pressing 'enter' on your keyboard while a permanent fix is made. Please note that HESA's import process of your Inserted data will now handle date values correctly, even if a timestamp is showing on the template. |

Closed | 21 November 2018 | 22 November 2018 |

|

Issue ID: 67535 - Table 1 Head 16e formula reverted The formula for Table 1 Head 16e was changed for C17031. Unfortunately this has been found to be incorrect and so has been reverted back to the calculation used in C16031. |

Closed | 16 November 2018 | 22 November 2018 |

|

Issue ID: 67367 - Conditional formatting in Table_1_UK and Table_3_Scotland Some of the formulae for the conditional formatting in column M 'Variance (2017/18 v. 2016/17 restated)' are incorrectly referencing the wrong cells, meaning that the shading is not always accurate. |

Closed | 14 November 2018 | 22 November 2018 |

|

Issue ID: 67352 - QR.General.Insert.6 (1005) This rule is incorrectly triggering in Table 11, Heads 10a and 10b. The rule states that values are to be returned in £000's and therefore cannot have decimal places, but these Heads (new for C17031) are recorded to one decimal place. |

Closed | 14 November 2018 | 22 November 2018 |

|

Issue ID: 67301 - Converted template incorrect in Table 4 An issue has been identified in the 'Template version update' where the cell for the restated figure is reporting the value that should actually be as at the end of the year (Table 4, Head 9 - cell I60).

Additionally, the shading on this same cell is not currently working as expected. Please note that the main 'Template download' does not have this issue. |

Closed | 13 November 2018 | 22 November 2018 |

|

Issue ID: 67207 – Issues with template version 1.1 An issue has been identified with the template where the cell for the restated figure is shading red even if the figure is correct.

|

Closed | 8 November 2018 | 22 November 2018 |

|

Issue ID: 66722 – Issues with template version 1.0 Issues have been identified with the template. A newer version correcting these issues will be made available shortly. • Restated figures may be incorrect in the following:

Table 1 Head 1f – Donation and Endowments (Cell I11). Note: Cells using these figures in their calculation may also be incorrect. • Quality rule QR.C17031.Table11.3 is triggering if the cell is not blank and not equal to 31 July 2018. It should only trigger if the cell is not blank and not equal to or greater than 31 July 2018. This will be issues will corrected in Version 1.1 of the template. |

Closed | 30 October 2018 | 7 November 2018 |

Preparation guide

Key changes for 2017/18

There have been a number of changes to the Finance template for 2017/18. These are fully outlined in the Notification of Changes. Key changes include:

Revision to Table 6

Table 6 has been standardised for all countries. Under agreement from the funding bodies, all countries will now return information on the same categories of students. This is to ease the onward use of tuition fee data for students across different country administrations.

Fee income is now split by mode and level for home, other EU and non-EU students.

Providers will also need to return restated data for 2016/17 on Table 6. This is to enhance the data collected last year and provide the start of a time series. Restated data is only needed for C17031, and will not be an ongoing requirement in future collections.

New Tables

There are 3 new tables in C17031:

- Table 11 – Head of Provider renumeration

- Table 12 – Analysis of Staff Costs

- Table 13 – Severance payments

The funding bodies have stated in their Accounts direction that providers are required to include this information in their audited financial statements.

Accounts Directions

Providers can view the relevant Accounts direction through the below links (Providers in DfENI can contact the Department for a copy directly):

Office for Students – Accounts direction

HEFCW – Accounts direction

Scottish Funding Council – Accounts direction

The Revision history provides an overview of changes to the collection in view of the first and subsequent releases of the coding manual. The Notification log summarises all communications associated with the 2017/18 Finance collection.

C17031 Finance record template

A functional template will be available from the coding manual page, so that users can capture the information prior to submission. Providers will however need to return their finance data in their personalised provider template. This is available from the data collection system pre-filled with the provider’s UKPRN, name and country details, as well as prior year data in Tables 1 to 4 returned by the provider in 2016/17. Providers are able to restate these figures if necessary. To highlight where figures are restated the cells will change colour.

Collection user guide and supporting documentation

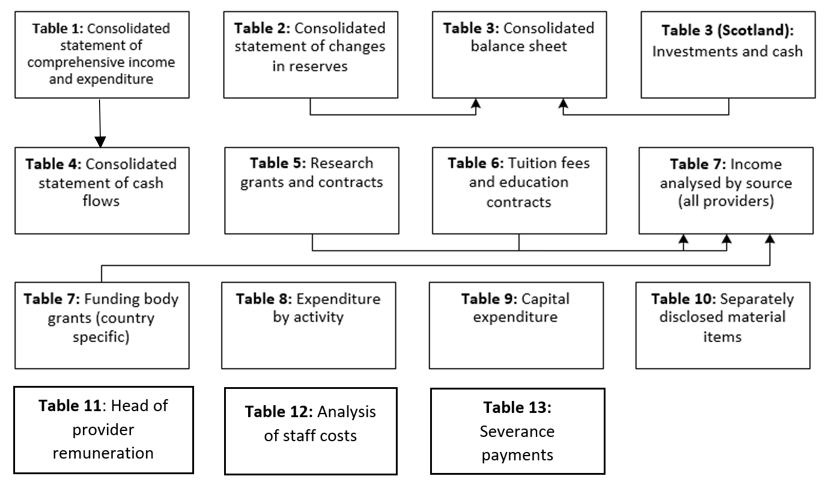

The coding manual provides detailed information on how to complete the tables for the Finance record. In addition, the Finance record collection user guide provides step-by-step guidance on how to submit data to HESA and the process of submission undertaken by providers. The diagram below shows the ordering and linking of the tables, and therefore indicates in which order providers should complete them.

Collection deadlines

A full outline of the data collection timescales can be found here.

3 December 2018 is a key deadline. Providers must have sent complete data, and resolved all errors, in order to commit their file in the data collection system. A single validation failure will result in no data being imported into the system. Data which fails validation will not be considered to have been returned to HESA.

Data from English providers is delivered to the Office for Students (OfS) from 3 December 2018 onwards for assurance exercises to be undertaken.

Providers in Wales and Scotland are also requested to send a copy of their published accounts to Liaison at HESA as soon as they become available, and no later than 3 December 2018. (Published accounts for providers in England and Northern Ireland will be forwarded to HESA by OfS by this date).

BUFDG Discussion board

To assist providers with queries they may have relating to the new SORP and the HESA Finance record 2017/18, BUFDG have set up a dedicated discussion board on their website (www.bufdg.ac.uk). Colleagues are encouraged to make use of this discussion board to raise any issues encountered when completing the Finance Record. This discussion board is intended as a self-help tool but will be monitored by BUFDG FRG, the funding bodies and HESA, who will issue further guidance if deemed necessary.

Responding to Minerva queries

Data quality queries are raised through the Minerva system and providers are required to resolve all Minerva queries within the collection timeframe. As best practice providers should interact with Minerva and the HESA data collection system frequently throughout the collection period to gradually resolve issues either through providing explanations of genuine data or submitting revised data that corrects issues identified. Through adopting this approach providers are able to iteratively improve the quality of their data and expose issues in a timely manner leading to better quality returns.

Record contact changes

The record contact is the first point of communication during data collection. If these details have changed please ensure you notify [email protected] to prevent any delay in the receipt of important communications.

HESA Identity System

The HESA Finance record contact for each provider will have access to the HESA data collection system and through the IDS will be able to invite additional colleagues to also have access to the system to submit data and view reports. Please ensure that the correct roles are in place to ensure the necessary access required by colleagues ahead of the collection opening.

The Identity System user guide provides detailed help with using HESA's single sign-on system.

Stages of data submission

A. Sending data

Data can be uploaded by clicking on the “Send Data” button.

Browse your computer to locate the file you wish to submit and upload the file to the Data Collection System.

Tips:

- The template can be saved with any name

- Only one file can be sent at a time

- The system does not support Excel 2003.xls format or older. Please 'Save as Type' Excel 2007.xlsx files.

- Files must be returned using the most recent template (.xlsx) provided by HESA. The template for the Finance return can be downloaded from the Data Collection System under “Latest Reports and Downloads”.

B. Validation

Insert-stage validation checks will now run. To pass insert-stage validation the file must not trigger any validation errors. Validation errors and warnings are listed in cells D2 and D3 of the Excel templates. To pass validation these counts should be at zero.

i. What to do if the file fails validation

If the file fails validation the system will show the below status and reports. You should review the errors (and warnings if any). Make any necessary corrections to the data and resubmit.

To pass insert-stage validation you will need to resolve all errors listed within the report.

How to obtain a switch

When errors are triggered in the Data Collection system but the data has been checked and is genuine, you need to request a switch. This is because your file will not pass the validation requirements of the collection deadlines if there are any remaining errors.

Please email your switch request to Liaison, stating which rule is causing the error to be triggered and for how many records, together with an explanation as to why the data is genuine.

This will then be forwarded to your funding council/regulator for them to review. They may agree the switch, ask for more information or state how they wish the data to be returned so that an error is no longer triggered.

This request should be sent well in advance of any deadline, to allow sufficient time for a decision to be made.

When a switch has been agreed, it will be applied to your data for the count specified and the data will be reprocessed. This will resolve the error.

If the count increases, the rule will be triggered again, and you will need to request that the count on the switch be increased. This will be forwarded to your funding council/regulator for approval.

ii. What to do when the file passes validation

You should review any validation warnings in the webform to ensure that the submitted data is genuine or correcting and resaving the data where necessary.

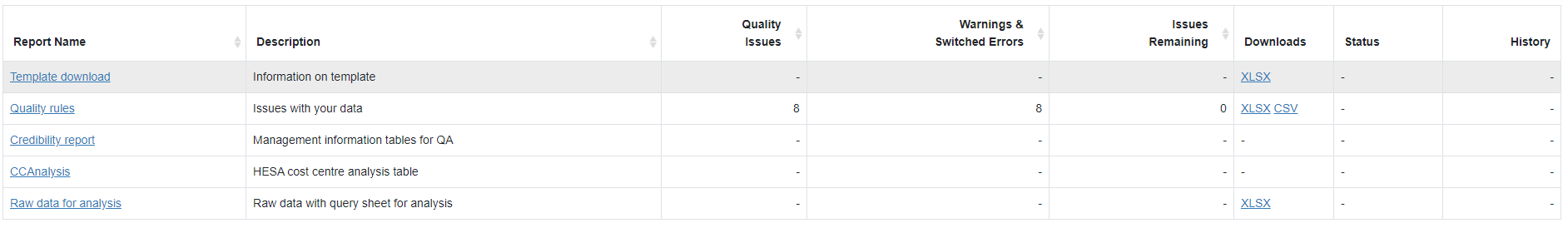

If the file passes insert-stage validation it will generate the suite of reports. These reports should be reviewed to ensure that the submitted data is an accurate reflection of your profile. We will also review these reports.

To proceed to commit-level validation a valid file needs to have been submitted and passed insert-stage validation checks. The data will then be classed as “Committable”.

COMMIT

Once you are content with the data, you should commit your submission by processing a COMMIT transaction. This transaction will then send a copy of the submission to the HESA Data Quality Assurance team for us to undertake analysis of the return in parallel with you conducting your own analysis.

i. What to do if the file fails COMMIT?

If the file fails commit-level checks you should review the error report produced by the system, make any necessary corrections to the file and resubmit it.

Deleting files

Where you need to make amendments to data, upload a new file. Although all transactions are stored in the system, the new submission will replace the old one.

Why can't failed files be deleted?

Where a file fails insert-stage validation, the data contained within it is not uploaded to the HESA database and so will not be counted as part of the return.

ii. What to do if the file passes COMMIT?

Decommitting

A passed COMMIT transaction will lock the system to prevent the data from being amended and to allow the HESA Data Quality Assurance team to undertake analysis of the submission. To unlock the system you will need to request a DECOMMIT transaction from HESA. This will reverse the current commit and allow you to delete, resend and recommit data.

I need to amend my data, how do I get it decommitted?

You will need to contact Liaison either by emailing [email protected] or calling on 01242 388531 to request a decommit transaction.

Once we have analysed your committed return, data quality queries will be posted onto the Issue Management System data quality database. Relevant users will be notified by email when these queries are available to view. The Issue Management System user guide provides help on using the Issue Management System.

Once your data has passed all the stages of validation, and any issues highlighted during credibility checking have been addressed, we will set the return to CREDIBLE. This produces the sign-off form.

When data is set to credible, a link to the sign-off form is automatically emailed to the head of the submitting organisation as well as the appropriate record contact. The form should be completed and signed by the head of the reporting organisation and returned to us by email or post. This verification offers both you and us assurances regarding onward use of the data.

Sign-off completes the data collection process.